Major water company uses accounting trick to inflate balance sheet by £1.68bn

BBC

BBCOne of England’s top-rated water companies is using an accounting trick to artificially inflate its balance sheet by more than a billion pounds, BBC Panorama has discovered.

Severn Trent Water claims that an investment is worth £1.68bn in its accounts, when in reality it has no value to the overall business.

The made-up money makes the company appear more financially robust and helps to support its bumper payouts to shareholders.

Severn Trent denies the accounts are misleading and says Panorama’s allegations are “completely inaccurate”.

The water company – which is regulated by Ofwat – is part of a complex web of companies in the wider Severn Trent plc group.

It serves more than eight million people across central England and mid-Wales and has been awarded the Environment Agency’s top four-star rating for environmental performance for a record five consecutive years. Its ultimate parent company, Severn Trent plc, is popular with investors, as it has consistently paid large dividends to shareholders.

But some of Severn Trent’s customers are unhappy. The Shrewsbury-based campaign group Up Sewage Creek wants more of the company’s earnings to be used to combat pollution in local rivers. “They’ve not updated the infrastructure, they’ve used our money to enrich themselves and enrich their shareholders,” one of the campaigners told us.

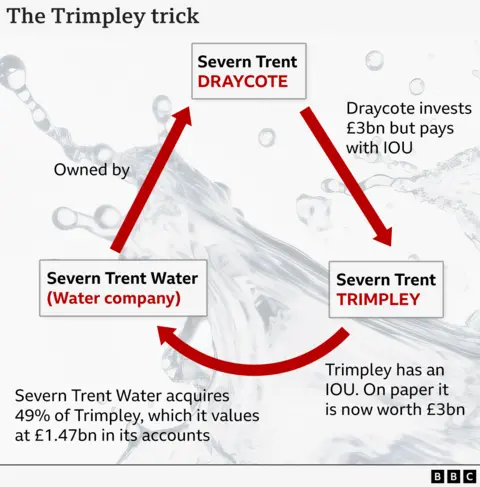

The complex accounting trick started in March 2017 when a shell company, with no money or assets, called Severn Trent Trimpley was set up as part of the group. Another Severn Trent company called Severn Trent Draycote – which owns the water company – agreed to buy Trimpley for £2.

Trimpley then issued additional shares and Draycote bought them for a staggering £3bn.

No money actually changed hands, however, as Draycote paid Trimpley with a £3bn loan note – effectively an IOU. But, on paper, Trimpley immediately appeared to be worth £3bn because it had the IOU.

Severn Trent Water then acquired 49% of Trimpley – and that investment was valued in the water company’s accounts at £1.47bn. A hugely valuable asset appears to have been created for Severn Trent Water out of thin air.

Panorama discovered the Trimpley investment through the work of retired auditor Stanley Root.

He told the programme: “This is as near to an unreal transaction as you can get – that has just been made up and put into the accounts to make the accounts look better.

“I think it misleads the reader to think that the net assets of Severn Trent Water Limited are higher than they are and that the company is in a much healthier position than it really is. So I think the balance sheet, the financial statements, are misleading.”

Since 2017, the made-up money on Severn Trent Water’s books has grown in value because of interest payments.

Draycote has agreed to pay Trimpley interest on the £3bn IOU, which means the IOU gets bigger each year.

As the value of the IOU goes up, so does the paper value of Trimpley. And that means Severn Trent Water’s investment in Trimpley rises every year too.

The Trimpley investment is now valued at £1.68bn in the regulated water company’s 2023/24 accounts.

Those accounts were audited and signed off by Severn Trent Water’s directors. When referring to the Trimpley investment, the accounts say: “In the opinion of the directors the fair value of the company’s investments are not less than the amount at which they are stated in the balance sheet.”

While that may be technically correct, the £1.68bn value is based on an IOU that is ultimately backed up by Severn Trent Water itself.

In the wider group accounts the made-up money is cancelled out by the IOU that Draycote issued, so it is only the balance sheet of the regulated water company, Severn Trent Water, that is inflated.

So why do it? Severn Trent told the BBC that Trimpley was set up to allow the water company to legitimately account for future earnings, but that it has never been used for that purpose.

Another possible explanation is that Trimpley helps support increased dividends.

As well as bolstering the balance sheet, the made-up £1.68bn has also been added to Severn Trent Water’s retained earnings – that is the pot of money from which cash can be paid out to shareholders. The more money there is in that pot, the easier it is to justify large dividends.

Since Trimpley was added to the accounts in 2017, Severn Trent Water Ltd has paid out £1.615bn in dividends.

Profits over the same period were £1.246bn, so Severn Trent Water has paid out £369m more than it made in profit during that period. It looks like cash is being drained from the regulated water company.

Auditor Stanley Root says water companies are under great pressure to pay substantial dividends and the Trimpley scheme helps Severn Trent Water deliver.

“It makes the company’s balance sheet look more stable than it really is. It gives them the appearance of financial resilience. It helps to support the dividend payments they’re making.”

Severn Trent denies that Trimpley has supported shareholder payouts: “All dividends paid by Severn Trent are justified by earnings and any assertion otherwise is unjustified and wrong.”

However, it is clear that Trimpley is having a dramatic effect on the pot of money from which shareholders can be paid.

Severn Trent Water’s 2023/24 accounts – which include the £1.68bn investment – report the company has very healthy retained earnings of £1.84bn.

But the accounts for the wider Severn Trent Group, where all the creative accounting is cancelled out, show retained earnings of just £7.9m.

Severn Trent says: “Trimpley is an entirely legitimate, legal and transparent structure.”

Its accounts are independently audited and “any suggestion that we have misled our investors, regulators and customers on the company’s finances is false”.

It says the IOU is “very much a real asset” as it is backed up by other group companies.

Severn Trent also says it is in good financial health, it raised an additional billion pounds from shareholders last year and will continue to invest record amounts into infrastructure.