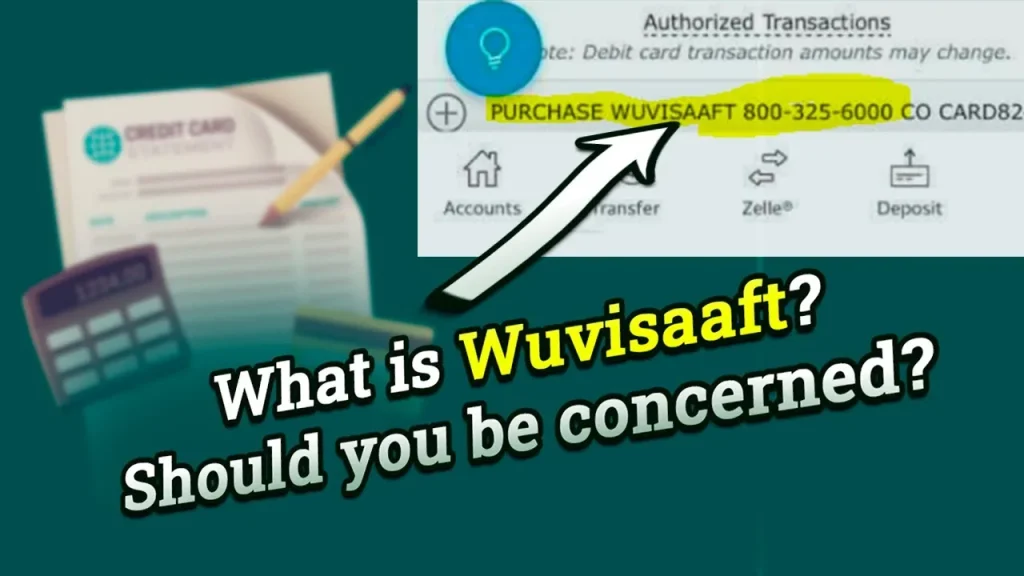

What Is the WUVISAAFT Charge on Bank Statement?

If you find yourself perplexed by the “WUVISAAFT” charge on your bank statement, much like others, and you’re uncertain about its meaning, we’re here to clarify everything about the “WUVISAAFT” charge on your bank statement. Additionally, we’ll assist you in avoiding it in the future. A “wuvisaaft” charge is applied when you conduct a transaction through Western Union using any Visa Card.

The “wuvisaaft” charge lacks a precise definition as it comprises nine words, representing Western Union Visa Credit Account Funding Transaction. Nevertheless, it carries significant value and meaning in the financial sector. Let’s delve into what the “wuvisaaft” charge signifies.

Decoding the Charge Code: WUVISAAFT

WU – represents Western Union.

VISA – denotes a Visa Credit account.

AFT – signifies Account Funding Transaction.

What is the “wuvisaaft” charge?

Western Union (WU) is a global financial services institution offering secure and swift money transfers worldwide. Western Union’s collaboration with Visa is a crucial aspect of the company’s strategy to provide consumers, businesses, and governments with novel ways to execute fast, secure, and convenient financial transactions. A “WUVISAAFT” charge is applied when you conduct a transaction through Western Union using any Visa Card.

Why does the “WUVISAAFT” charge appear on my bank statement?

If you spot the “WUVISAAFT” charge on your bank statement, there’s no need to worry; it’s legitimate. It indicates that you’ve conducted a transaction through Western Union using a Visa Card. Western Union earns revenue by charging fees for currency exchange and fund transfers.

How does the “WUVISAAFT” charge appear on a bank statement?

Comprehending the “wuvisaaft” charge on your bank statement can be challenging for individuals. Multiple codes and descriptions are often provided for the same transaction, with variations in transaction names based on the bank and region. Below are some common transaction names for the “WUVISAAFT” charge on a bank statement.

- WUVISAAFT 8003256000 (Western Union’s customer care number)

- WU 800-325-6000 co

- WU 800-325-6000 co us

- Western Union

- WU Pay

- WU Deposit

- WU Transfer

- WU Payment

- WU Reload

- WU E-check Deposit

Know about other charges on bank statement.

How to Avoid “wuvisaaft” Bank Charges

Conduct transactions through your bank:

To minimize additional charges, such as dash charges on your bank statement, consider opening an account with their affiliated banks. Conduct all your transactions through these banks instead of using Western Union.

Regularly review charges:

It’s crucial to regularly review all your transactions and balances. After each transaction, verify your bank balance to ensure the correct amount is debited from your account.

Set up alerts:

Many banks offer notifications for each transaction. Utilize this feature to avoid unexpected charges or transactions in your bank account.

Minimize unnecessary transactions:

To reduce charges on your bank statement, limit transactions to those essential for your needs. Avoid unnecessary transactions and focus only on those that are vital.

In conclusion:

In a nutshell, this article encompasses all facets of the “WUVISAAFT” charge on your bank statement related to using Western Union with your Visa card for payment processing. It is legitimate, so there’s no need to worry.